With the introduction of Unified Payment Interface this year, Government has brought a right solution for the payment related services fulfilling the dream of digital India. UPI service is totally different from the digital wallet services that already existed.UPI services in future may dominate digital wallets as the operational costs are relatively less. But there are key advantages of using digital wallets like convenience, cashback and can be paid without much technical knowledge.

The UPI services have been launched in August this year and SBI and HDFC bank are late entrants to this services. As these two banks share half the market share in Banking, the UPI services are not widespread till now.

Now HDFC has come with adding the UPI feature in the mobile banking app itself making the usability more convenient. To obtain this service update your HDFC mobile banking app to the latest version.

How does UPI work:

- Payments are made through Virtual address without using an account number and IFSC code

- UPI has two-factor authentication system which makes it more safe and secure

- Payments can be made to merchants if he has UPI as payment receive option enabled

- You can send and receive money 24×7 even on a public holiday or sunday.

- There will no additional charge for the fund transfer unlike NEFT and IMPS which charges a particular amount for their usage

How to Setup the UPI services in HDFC Mobile Banking App:

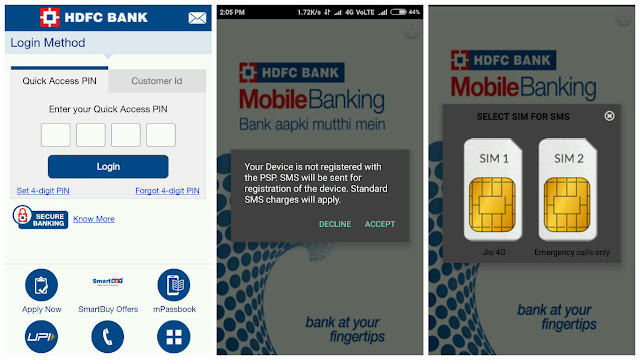

- Open the HDFC Mobile Banking App ( Update to the latest version)

- Scroll down to locate the UPI service in the bottom. Click it

- Then you will be asked to register your device with PSP.

- An SMS will be sent for the registration process

- Then select your SIM for the service (select the SIM registered with HDFC Bank)

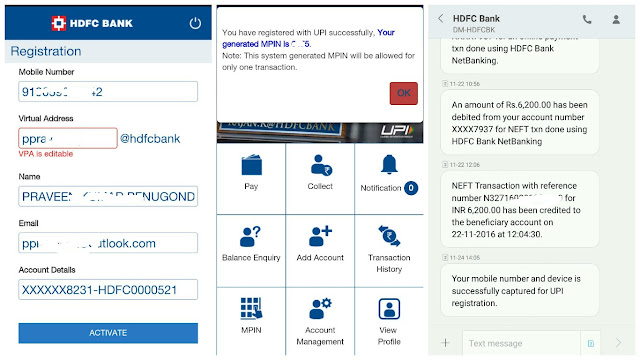

- Then you will find the pre-filled account details like in the screen shot

- You can edit the Virtual address and set with your preferred one

- The rest of the things cannot be edited

- Click Activate

- Then you will see a popup in the top showing MPIN

- You will also receive a confirmation SMS confirming the registration

- You will find the services like Pay, Collect, Balance enquiry, Transaction History, MPIN

- To pay money click Pay

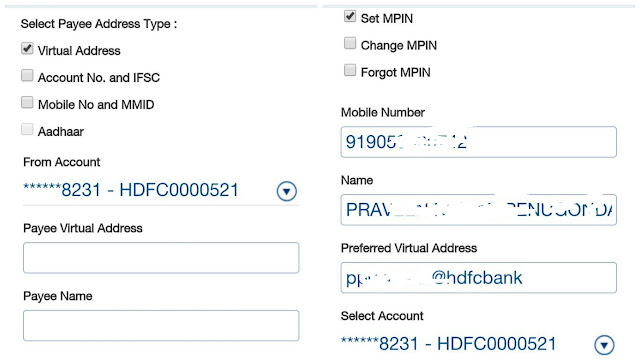

- Now, select Payee address type. you can check any of the 4 options (Virtual address, Acc no, Mobile number, Aadhar number) based on your convenience

- Enter payee name and amount and proceed

- Enter MPIN and get the transaction confirmation

- You can also change your MPIn by clicking MPIN in the main menu and follow the steps